Status Of Deceased In Income Tax . you must lodge a date of death tax return if any of the following applied to the deceased person in the. Determine if the deceased person has worked. when an individual passes away, their tax obligations do not cease immediately. what to do when someone dies, getting authority to deal with the ato, lodging a final tax return, and trust tax returns. for the first three income years, special progressive tax rates apply to deceased estates, which are generally. The executor or administrator must lodge a final tax. Pay any tax on the net. notify the australian taxation office (ato) of the death (see step 32.1 above); you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: report all income of the deceased estate after the date of death in the trust tax return;

from taxadda.com

Pay any tax on the net. The executor or administrator must lodge a final tax. you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: Determine if the deceased person has worked. for the first three income years, special progressive tax rates apply to deceased estates, which are generally. you must lodge a date of death tax return if any of the following applied to the deceased person in the. notify the australian taxation office (ato) of the death (see step 32.1 above); when an individual passes away, their tax obligations do not cease immediately. what to do when someone dies, getting authority to deal with the ato, lodging a final tax return, and trust tax returns. report all income of the deceased estate after the date of death in the trust tax return;

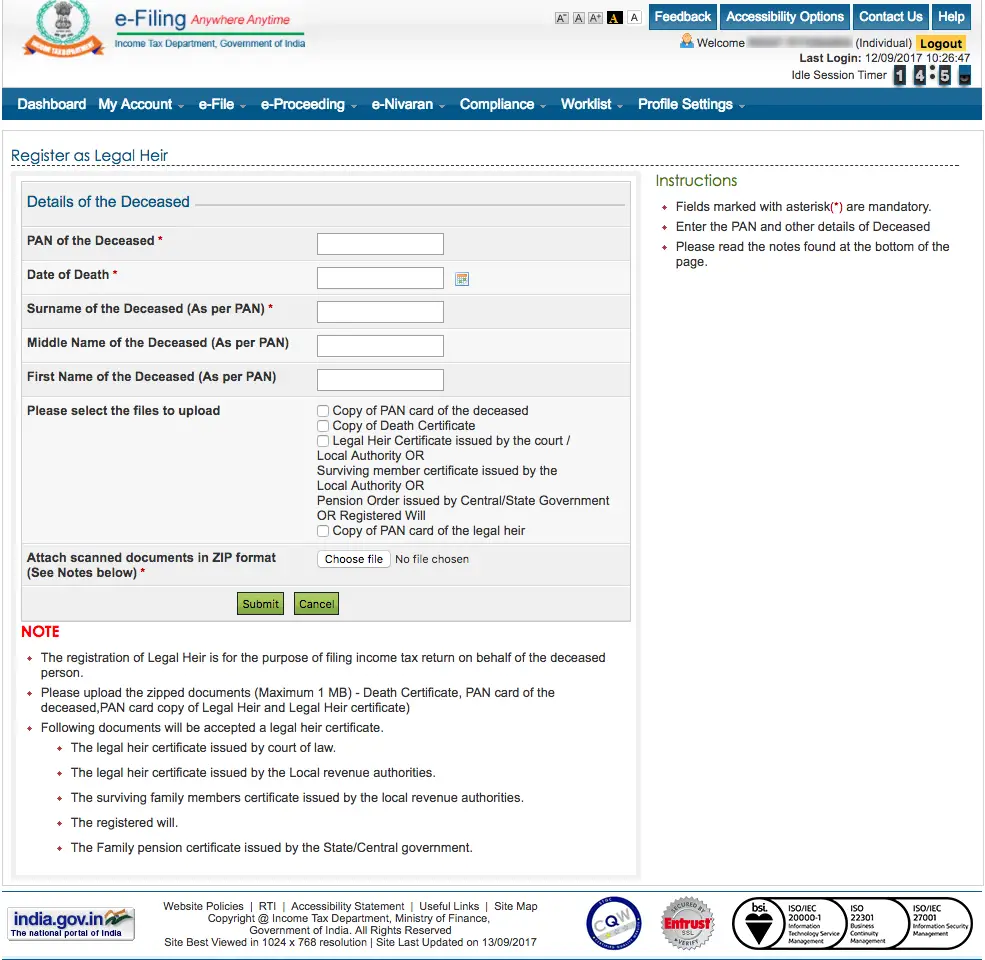

How to file Tax Ereturn for deceased person?

Status Of Deceased In Income Tax Determine if the deceased person has worked. when an individual passes away, their tax obligations do not cease immediately. Pay any tax on the net. report all income of the deceased estate after the date of death in the trust tax return; The executor or administrator must lodge a final tax. you must lodge a date of death tax return if any of the following applied to the deceased person in the. what to do when someone dies, getting authority to deal with the ato, lodging a final tax return, and trust tax returns. Determine if the deceased person has worked. for the first three income years, special progressive tax rates apply to deceased estates, which are generally. notify the australian taxation office (ato) of the death (see step 32.1 above); you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died:

From cachandanagarwal.com

Tax A stepbystep guide to filing ITR for a deceased person Chandan Agarwal Status Of Deceased In Income Tax you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: when an individual passes away, their tax obligations do not cease immediately. for the first three income years, special progressive tax rates apply to deceased estates, which are generally. . Status Of Deceased In Income Tax.

From www.irstaxapp.com

IRS Deceased Taxpayer Filing & Other Tax Obligations Internal Revenue Code Simplified Status Of Deceased In Income Tax The executor or administrator must lodge a final tax. Pay any tax on the net. notify the australian taxation office (ato) of the death (see step 32.1 above); you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: you must. Status Of Deceased In Income Tax.

From cleartax.in

How to File Tax Return for the Deceased by Legal Heir Status Of Deceased In Income Tax you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: you must lodge a date of death tax return if any of the following applied to the deceased person in the. when an individual passes away, their tax obligations do. Status Of Deceased In Income Tax.

From gstguntur.com

How To File Tax Return for Deceased Person GST Guntur Status Of Deceased In Income Tax The executor or administrator must lodge a final tax. report all income of the deceased estate after the date of death in the trust tax return; for the first three income years, special progressive tax rates apply to deceased estates, which are generally. what to do when someone dies, getting authority to deal with the ato, lodging. Status Of Deceased In Income Tax.

From www.youtube.com

Filing of Tax Returns in case of Deceased Person YouTube Status Of Deceased In Income Tax for the first three income years, special progressive tax rates apply to deceased estates, which are generally. Pay any tax on the net. when an individual passes away, their tax obligations do not cease immediately. Determine if the deceased person has worked. notify the australian taxation office (ato) of the death (see step 32.1 above); The executor. Status Of Deceased In Income Tax.

From www.formsbank.com

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer printable pdf Status Of Deceased In Income Tax Determine if the deceased person has worked. The executor or administrator must lodge a final tax. Pay any tax on the net. for the first three income years, special progressive tax rates apply to deceased estates, which are generally. report all income of the deceased estate after the date of death in the trust tax return; when. Status Of Deceased In Income Tax.

From www.formsbank.com

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer printable pdf download Status Of Deceased In Income Tax you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: Determine if the deceased person has worked. Pay any tax on the net. for the first three income years, special progressive tax rates apply to deceased estates, which are generally. . Status Of Deceased In Income Tax.

From www.formsbank.com

Form 5747 Statement Of Person Claiming Refund On Behalf Of A Deceased Taxpayer printable pdf Status Of Deceased In Income Tax when an individual passes away, their tax obligations do not cease immediately. notify the australian taxation office (ato) of the death (see step 32.1 above); you must lodge a date of death tax return if any of the following applied to the deceased person in the. what to do when someone dies, getting authority to deal. Status Of Deceased In Income Tax.

From taxadda.com

How to file Tax Ereturn for deceased person? Status Of Deceased In Income Tax you must lodge a date of death tax return if any of the following applied to the deceased person in the. Determine if the deceased person has worked. The executor or administrator must lodge a final tax. notify the australian taxation office (ato) of the death (see step 32.1 above); what to do when someone dies, getting. Status Of Deceased In Income Tax.

From amynorthardcpa.com

How to File IRS Form 1310 Refund Due a Deceased Taxpayer Status Of Deceased In Income Tax you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: when an individual passes away, their tax obligations do not cease immediately. Pay any tax on the net. Determine if the deceased person has worked. you must lodge a date. Status Of Deceased In Income Tax.

From www.hrblock.com

Using Form 1041 for Filing Taxes for the Deceased H&R Block Status Of Deceased In Income Tax report all income of the deceased estate after the date of death in the trust tax return; Pay any tax on the net. you must lodge a date of death tax return if any of the following applied to the deceased person in the. Determine if the deceased person has worked. what to do when someone dies,. Status Of Deceased In Income Tax.

From learn.financestrategists.com

Death Taxes Definition, Limits, Calculation, Pros & Cons, How to Avoid It Status Of Deceased In Income Tax you must lodge a date of death tax return if any of the following applied to the deceased person in the. Pay any tax on the net. you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: notify the australian. Status Of Deceased In Income Tax.

From www.formsbank.com

Form L1310 Statement Of Claimant To Refund Due Deceased Taxpayer Form State Of Michigan Status Of Deceased In Income Tax you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died: what to do when someone dies, getting authority to deal with the ato, lodging a final tax return, and trust tax returns. Pay any tax on the net. notify the. Status Of Deceased In Income Tax.

From insightfulfinancial.ca

Filing the Final Tax Return for Deceased Person Insightful Financial Status Of Deceased In Income Tax Determine if the deceased person has worked. when an individual passes away, their tax obligations do not cease immediately. notify the australian taxation office (ato) of the death (see step 32.1 above); you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which. Status Of Deceased In Income Tax.

From www.slideteam.net

Tax Deceased In Powerpoint And Google Slides Cpb Status Of Deceased In Income Tax for the first three income years, special progressive tax rates apply to deceased estates, which are generally. notify the australian taxation office (ato) of the death (see step 32.1 above); you must lodge a date of death tax return if any of the following apply to the deceased person in the income year in which they died:. Status Of Deceased In Income Tax.

From www.stoufferlegal.com

Filing a Final Tax Return After the Death of a Loved One Status Of Deceased In Income Tax Determine if the deceased person has worked. notify the australian taxation office (ato) of the death (see step 32.1 above); report all income of the deceased estate after the date of death in the trust tax return; Pay any tax on the net. you must lodge a date of death tax return if any of the following. Status Of Deceased In Income Tax.

From www.formsbank.com

Fillable Form 507 Oklahoma Statement Of Person Claiming An Tax Refund Due A Deceased Status Of Deceased In Income Tax Pay any tax on the net. report all income of the deceased estate after the date of death in the trust tax return; you must lodge a date of death tax return if any of the following applied to the deceased person in the. what to do when someone dies, getting authority to deal with the ato,. Status Of Deceased In Income Tax.

From wealth4india.com

how to file tax return for the deceased person by legal heir? Status Of Deceased In Income Tax report all income of the deceased estate after the date of death in the trust tax return; The executor or administrator must lodge a final tax. Pay any tax on the net. notify the australian taxation office (ato) of the death (see step 32.1 above); for the first three income years, special progressive tax rates apply to. Status Of Deceased In Income Tax.